How to save money: 9 Simple strategies for financial success

💡 We all want to boost our savings without sacrificing our lifestyle. Here's am sharing some tips for smart money-saving techniques!

- Boost Your Income 💪

The golden rule of savings Earn more! Upskill yourself or find ways to make money that don't trade time for cash. While increasing income will take time, let's explore some quick wins: - Track & Trim ✂️

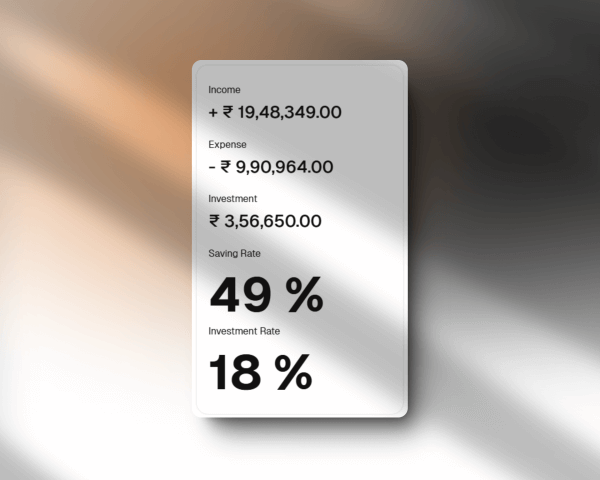

Use expense tracking tools (like lit.money!) to spot and cut unnecessary spending. Knowledge is power when it comes to your finances! - Automate Your Savings 🏦

As soon as your paycheck or any income hits, move a fixed amount to savings or investments. Track and aim for at least a 20% savings rate. Make saving a habit, not an afterthought! I wanted to focus on my saving rate so I added it on lit.money's dashboard.

- Need vs. Want Game 🎯

Before buying anything, ask yourself: Is this a need or a want? Wait a day before purchasing to avoid impulsive buys. Many times our brain needs domain to make purchases that do not last long. Nowadays developers and growth persons show you FOMO alerts like "Order now and get 100$ OFF + Free Shipping", ignore them.

- Become a Bargain Boss 🕵️

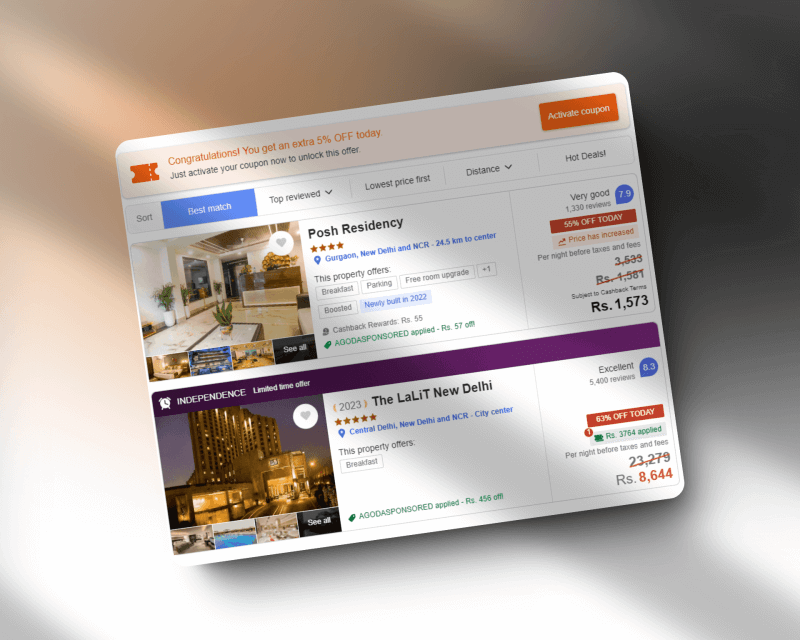

Develop your negotiation skills. From insurance premiums to salaries, everything's negotiable. If you find bargaining is not for you then just ask for a discount in return for offering a review for great service! If you're on an e-shop website then chat with a live support agent and ask discount code. many times it works for me. - Time Your Spending Wisely ⏰

Avoid weekend surcharges on travel, hotel booking, dining, and entertainment. Midweek deals can seriously pad your wallet! - Kick Costly Habits 🚭

Quitting smoking or reducing tobacco use? Your body and bank account will celebrate! - Optimize Your Internet Costs 📶

Share a Wi-Fi plan with family members instead of individual data plans. More connection, less expense! I am including this because it worked for me. - Cut down your Subscription 💳

Check your expense tracking & see if you have any online streaming, gaming, gym, or any subscriptions that you are not using, cancel them!

Bonus Tips:

- Audit your subscriptions regularly 📺

- Plan budget-friendly weddings 💍

- Use cashback and reward programs 💳

Remember, saving money is a journey, not a destination. Start small, stay consistent, and watch your savings grow! 🌱💰

P.S. Speaking of smart financial moves, have you tried lit.money yet?

Posted by

👋 Hi, I’m Mihir! I’m passionate about creating things on the internet, spending quality time with my family, and, of course, hanging out with my cats. Right now, I’m focused on building lit.money, a personal project close to my heart. I’m also the founder of Green, where I develop tech solutions for founders and businesses to help keep the lights on (and pay my bills).

Mihir Naik

Mihir Naik